KYC the context of a CRM

In the context of Customer Relationship Management (CRM), “KYC” stands for “Know Your Customer.” KYC in CRM refers to the integration of Know Your Customer processes and practices within a CRM system. CRM systems are software platforms that businesses use to manage and analyze interactions with their customers, leads, and contacts. Integrating KYC into a CRM system helps businesses gather, verify, and manage customer information in a way that supports compliance with regulations and enhances the customer relationship.

What Is KYC in a CRM Environment?

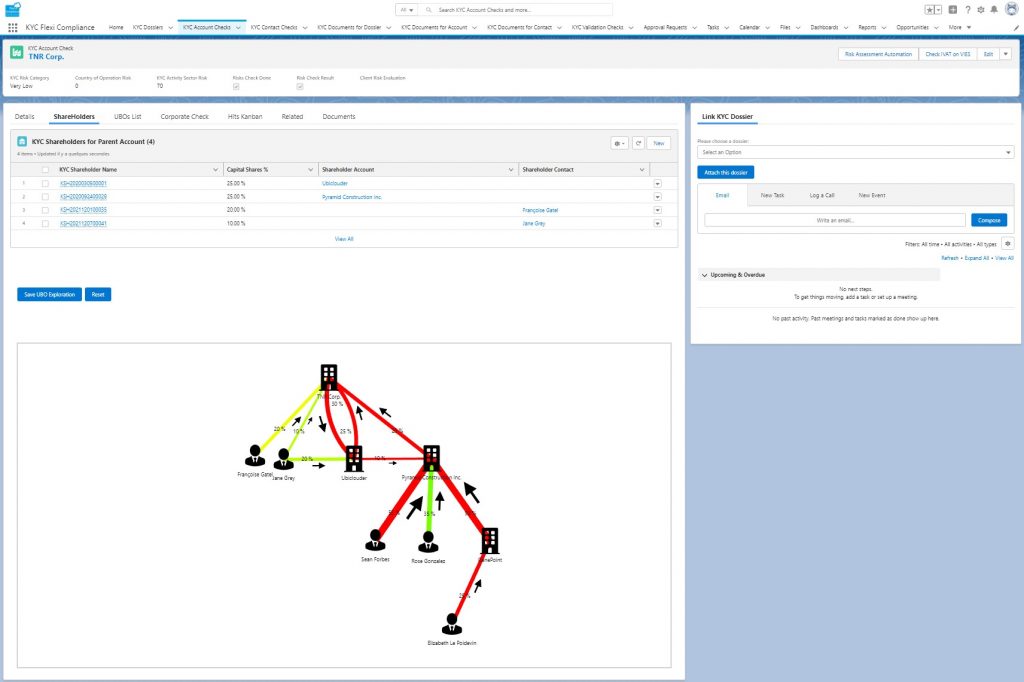

KYC in CRM means embedding customer identity verification, risk assessment, and due diligence directly within your customer management workflows.

Instead of running manual checks or switching tools, your CRM becomes a single source of truth — a compliance cockpit — where you can monitor and document every verification step automatically.

A KYC-enabled CRM typically includes:

– Customer identity verification

– Advanced entities relations

– Sanctions and PEP screening

– Risk scoring

– Document management

– Continuous monitoring and audit trails

Why Integrate KYC into Salesforce CRM?

Compliance Efficiency

Integrating KYC into Salesforce reduces repetitive data entry and human error. Compliance officers can view, update, and approve customer data within a single system.

By centralizing identity checks, you create a seamless audit trail for regulators and internal teams alike.

Data Accuracy and Automation

When Salesforce handles KYC tasks, automation ensures that all customer records stay current.

For example:

– Automatically trigger re-verification workflows when customer data changes.

– Sync compliance results across departments (sales, support, compliance).

This **automation-first approach** increases both data reliability and operational speed.

How to Implement KYC in Salesforce?

Using Native Tools

Salesforce provides native objects and automation tools such as **Flows**, **Validation Rules**, and **Custom Objects**.

You can design a simple KYC process where customer verification data is captured and validated automatically during onboarding.

Using Custom or Marketplace Apps

Tools like **FlexiKYC** extend Salesforce to offer full KYC functionality — including adverse media review, sanctions screening, and ongoing monitoring.

These apps can connect to APIs (like OFAC or EU sanction lists) and automatically enrich customer profiles with compliance results.