Luxembourg,

Livange, L-3378

Zone d’activité, sis rue Geespelt 1-5

+352 279 978 51

Call us

Mon - Fri: 9:00 - 17:30

Heure d'ouvertures

Zone d’activité, sis rue Geespelt 1-5

Call us

Heure d'ouvertures

In an era where digital transformation accelerates at an unprecedented pace, the risks associated with cyber activities and financial crimes are more pronounced than ever.

It can adapt any industries : KYC (Customers), KYB (Businesses), KYA (Assets), KYV (Vessels)

Organizations worldwide face critical challenges to secure their businesses.

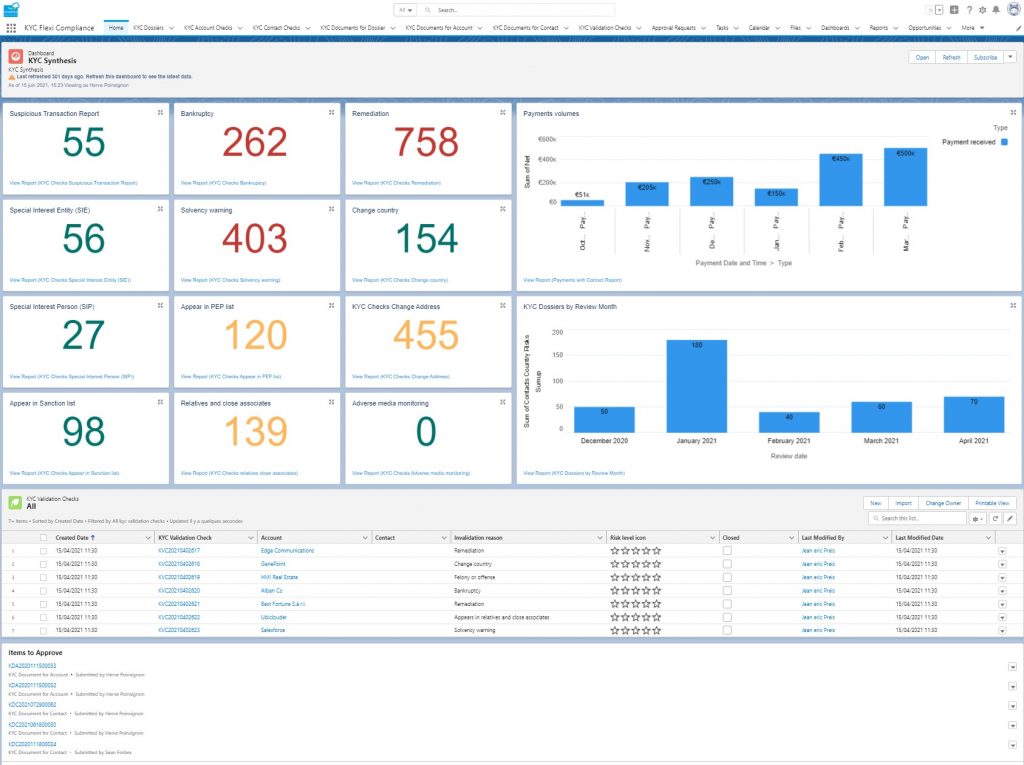

FlexiKYC is a flexible solution with the following objectives:

Experience the future of KYC and AML compliance with FlexiKYC. Ready to elevate your compliance framework?

The Made in Luxembourg label is a brand created in 1984 on the initiative of the Ministry of Foreign Affairs, the Chamber of Commerce, and the Chamber of Trades. It is used to identify the Luxembourg origin of products and services. The label concerns goods produced in the Grand Duchy and services provided from Luxembourg with high reliability.

FlexiKYC certified by Checkmarx and guarantees highest industry security levels in the world. Two-Factor Authentications, Password Policies, Login IP Ranges, Decrease Session Timeout Thresholds.

No reprogramming, tests and time, our technology is based on flexible components even for documents uploads.KYC Processes offers a variety of flexible flows which permits to adapt any requirement in a short time.

Your customers is onboarded directly on the community. Fields and documents are adapted to his profile. Your customers can upload and refresh their documents directly without intervention.It increases productivity.

FEATURES | ADVANTAGES |

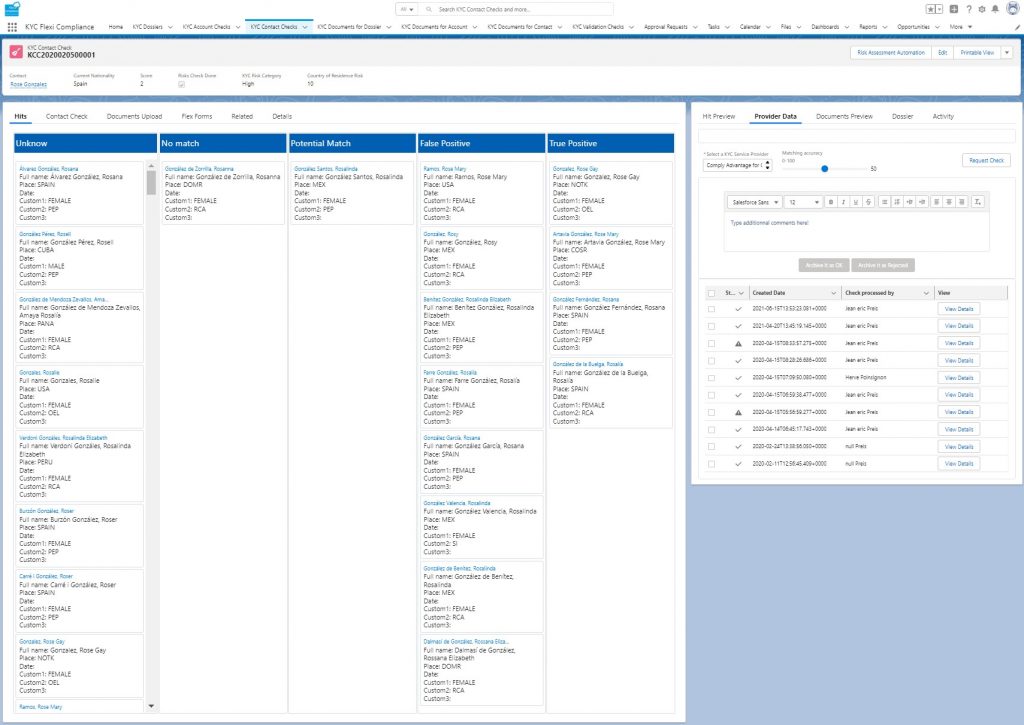

| Multi KYC data providers | Ability to choose data providers by country. No lock change data provider without changing you KYC process. |

| Universal connector | Use Ubiclouder template integration (Dow Jones, Worldcheck…). |

| Open architecture | Create your custom integration from any sources. |

| Separation and integration between KYC Data and CRM Data | Manage GDPR and Privacy Compliance, separation of concerns. |

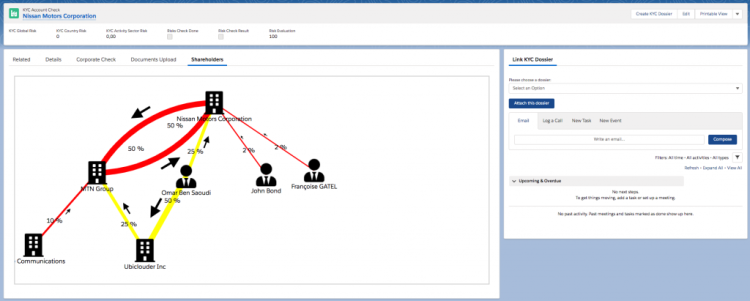

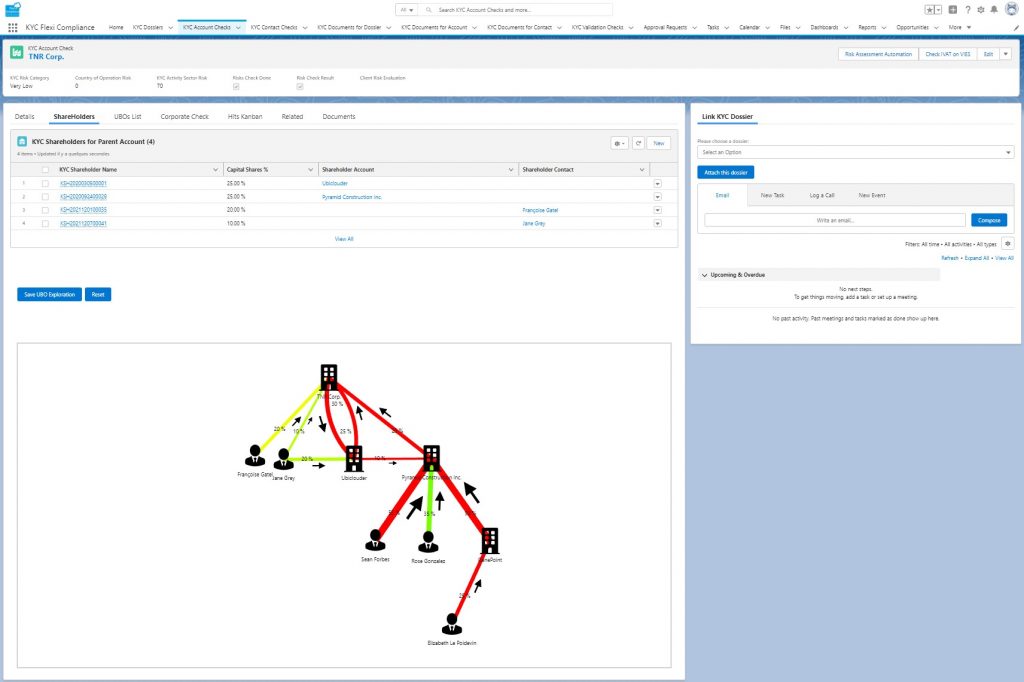

| Advanced KYC Dossier with UBO, shareholders, signaters and real time progress overview | Manage 360° all risks. Mannage in one view to reduce client onboarding time and ease activities planning and follow up. |

| Flexible forms and flexible uploads | No programming. Adapt to each country requirements and client profiles. |

| Fast KYC Hits review with Kanban and approval flow | Manage your risks with 4 eyes control and increase KYC Matchs classification productivity by 50% to 70%. |

| 24H/24H secured Customer Web Communities | Reduce onboarding time and increase document management productivity by 20% to 30%. |

fill in the information below, our team will contact you as soon as possible