First define what is KYC.

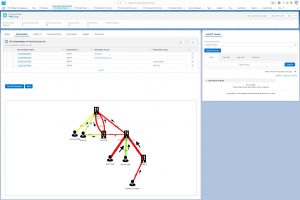

KYC stands for “Know Your Customer,” and it refers to the process by which businesses and organizations verify the identity of their customers or clients. KYC data includes the personal and financial information collected during this process. The purpose of KYC is to prevent illegal activities such as money laundering, fraud, and terrorist financing. You will need to understand who is your customer ? is he linked to a politacally exposed person or to a terrorist organisation. All countries maintain official lists of persons and organisation under sanctions. A graph helps you to understand relations.

Second define KYC Data types.

KYC data typically includes:

Personal Information: This includes details such as the customer’s full name, date of birth, address, nationality, and contact information.

Identification Documents: Customers are required to provide official identification documents such as a passport, driver’s license, or national ID card to verify their identity.

Financial Information: This may include the customer’s source of funds, employment details, income, and financial history.

Risk Assessment: Businesses may also collect information to assess the potential risk associated with the customer, such as their occupation, industry, and business activities.

Beneficial Ownership: In the case of businesses, KYC processes may involve identifying and verifying the beneficial owners or controllers of the business entity.